Usage Based Pricing: a new challenge for RevOps

Usage based pricing. The new frontier! Your sales team closed a monster deal last quarter. The contract looked perfect on paper. But three months in, finance is pulling their hair out trying to reconcile usage data. Customer Success can’t explain the bill. And your sales comp plan is incentivizing exactly the wrong behavior.

Welcome to the new reality of usage-based pricing where 61% of SaaS companies are racing toward a model that fundamentally breaks every RevOps system you’ve built (especially if you’ve come from seat based pricing).

Usage based pricing goes beyond price tweaking. That’s because it’s a business model transformation that most organizations are treating like a billing update. And the gap between those two approaches is costing companies millions in operational overhead, customer trust, and expansion revenue they should be capturing.

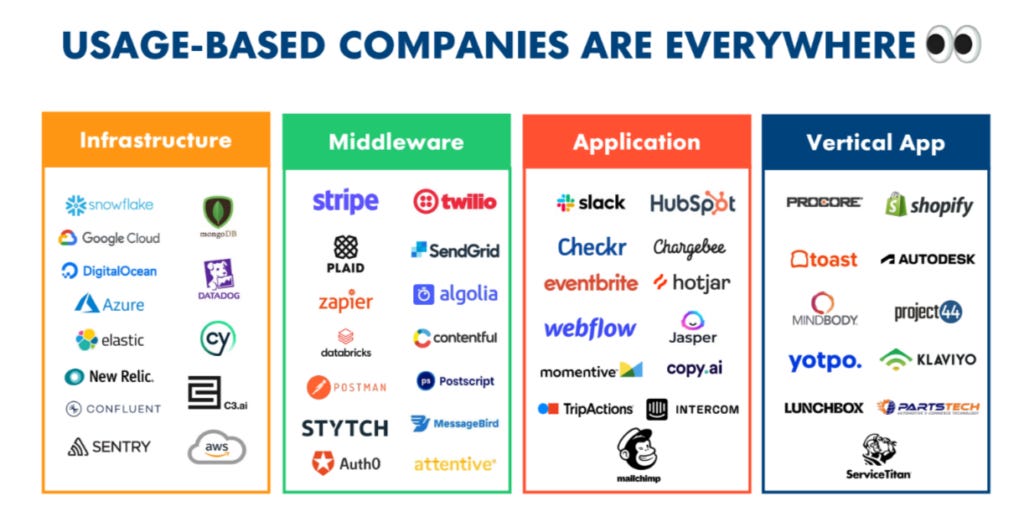

Usage based pricing is everywhere

Usage based pricing is everywhere. Credits are the fastest-growing pricing trend of 2025, with adoption jumping 126% year-over-year among the PricingSaaS 500. Companies like Figma, HubSpot, and Salesforce (one of the original seats based vendors!) have all launched credit models in the past year. The promise is obvious: align price with value, reduce friction to entry, capture organic expansion as customers grow.

There are examples of companies doing this right. Snowflake’s pure consumption model delivered a 158% net revenue retention rate. Twilio scaled to multi-billion dollar revenue on pay-per-message pricing. AWS revolutionized cloud computing by charging only for what you use.

Usage based pricing isn’t just a pricing model. It’s an entirely new operating system for your revenue organization. And most companies are trying to run it on infrastructure built for subscription contracts. This will fail in my humble opinion.

You’re no longer selling contracts. You’re selling initial adotion and focusing on growing usage. That changes everything.

Price Model vs. Price Metric

Before we dive into the operational chaos, let’s get clear on terminology. Too many RevOps leaders conflate pricing model (how you bill) with pricing metric (what you charge for).

Pricing model is your billing mechanism. Subscription means upfront payment for a period. Hybrid means some upfront, some based on actuals. Consumption means pay-in-arrears based on usage.

Pricing metric is what you’re measuring. Seats. API calls. Data processed. Messages sent. Compute hours. Credits consumed.

Here’s the spectrum of usage based metrics, from simple to complex:

Access metrics (users, logins, seats): Simple and understood, but increasingly unpopular. They don’t reflect actual value and can discourage adoption.

Technical usage (data processed, storage, compute costs, CPU time): Directly linked to your costs but hard for non-technical buyers to understand. Think AWS and Snowflake.

Activity metrics (tasks, interactions, messages, active users): The emerging “sweet spot.” Aligns to customer work patterns and is easier to forecast. Zapier built their model on this.

Output metrics (campaign clicks, successful resolutions, executions, deals closed): Proxies for productive work. n8n’s workflow automation pricing exemplifies this approach.

Credits (per enrichment, per action, per generated asset, per message): Consolidates multiple activities into a unified currency. Clay’s data enrichment credits are a prime example.

Outcome metrics (tickets resolved, revenue increase, cost saved, NPS improvement): Aspirational but extremely difficult to attribute. Chargeflow represents the bleeding edge, tying payment dispute resolution directly to recovered revenue.

The further right you move on this spectrum, the more value-aligned your pricing becomes and the more operationally complex your RevOps becomes.

Almost nobody runs pure consumption anymore. Even the poster children for usage based pricing offer hybrid models. Snowflake has committed use discounts. Twilio offers volume commitments alongside pay-as-you-go. The market has learned that pure variability creates too much risk for both buyer and seller.

The Five Operational Realities Nobody Warns You About

Let’s talk about what actually breaks when you move to usage based pricing. Let’s make them concrete.

Challenge #1: Forecasting Becomes Probabilistic, Not Deterministic

In a subscription world, forecasting is pipeline math. You know the deal size. You know the close probability. You multiply and sum. Finance loves it because ARR is predictable, and “bookings ≠ revenue” is a known problem with clear accounting rules.

In a usage world, that relationship evaporates. Usage is spiky, seasonal, and non-linear. One customer behavior change can swing your quarter. As one VP Finance told me: “CFOs lose confidence answering ‘Are we on plan?’ because the plan assumes usage patterns that may not materialize.”

You can’t forecast usage revenue like SaaS ARR. You need:

Cohort-based usage curves showing how consumption evolves post-sale for new, ramping, and scaled customers

Maturity buckets (new, ramping, scaled) with different revenue profiles

Separate committed revenue from consumption in hybrid models so you can track contracted vs. metered components

Scenario ranges instead of single number forecasts

If you’re still building your forecast model in a spreadsheet by multiplying pipeline by close rate, you’re not ready for usage based pricing.

Challenge #2: Telemetry Becomes a Customer Facing Product

Usage data isn’t just a backend table anymore. It’s a customer facing product surface.

In traditional SaaS, your product team owns the user experience. Billing happens separately in Stripe or Zuora. The customer sees a line item on an invoice. That’s it.

In usage based pricing, customers need to:

Understand what drives their bill before the invoice arrives

Forecast their own costs to budget appropriately

Trust that the usage numbers are accurate

See the connection between features used and value delivered

CS and Finance often don’t trust the same usage numbers. Customers discover their spend after the invoice drops, leading to disputes and erosion of trust. There’s no clear link between which features drove usage, which teams consumed resources, and what the cost drivers actually are.

Usage telemetry becomes a shared truth system that must be exposed to customers, not hidden in your data warehouse.

This means:

Real time usage dashboards in your product

Spend alerts and budget controls

Clear attribution from features → team activity → cost

Transparent methodology for how usage is calculated

Companies like Snowflake have built entire UIs around consumption visibility. This isn’t optional. It’s table stakes for earning customer trust in a variable pricing model.

Challenge #3: Sales Comp Plans Actively Work Against You

Traditional sales compensation is built around contract value. AEs get paid on TCV or ACV. They’re incentivized to maximize upfront commitment. Land-and-expand means selling bigger deals upfront, not starting small.

Usage based pricing flips this. You want:

AEs to sell smaller initial commits to reduce friction

Reps to prioritize accounts with high usage potential, not high commit potential

CS to drive expansion through deeper adoption

Product to influence revenue by improving features that drive usage

But if your comp plan still pays on bookings, your reps will:

Oversell commits to protect their commission

Avoid usage heavy deals that look smaller upfront

Leave expansion revenue on the table because they’re not incented to drive post-sale growth

Meanwhile, CS is being asked to drive expansion but has no quota or leverage. Product influences revenue but doesn’t own a revenue target.

Your org design and incentive structure are now in direct conflict with your operating model.

You need to fundamentally rethink:

Who owns expansion revenue (hint: it’s not just Sales anymore)

How CS gets compensated for driving usage growth

Whether Product should have usage-based success metrics

How to balance committed revenue vs. consumption in comp plans

This is an executive level conversation about organizational structure, not a Sales Ops spreadsheet fix.

Challenge #4: You’re Managing a Financial Operating System, Not a Pricing Model

Once you add usage based components, the complexity explodes:

Discounts on what? The commit? The overage? Both?

Rollovers of unused credits

Rebasing when customers change tiers mid-period

Multiple pricing models for different products

True-ups, prepaid drawdowns, and arrears billing

Revenue recognition for credits purchased but not consumed

Every exception becomes a precedent. Finance faces reconciliation and revenue recognition nightmares because ASC 606 wasn’t written for consumption models. Product logic gets tightly coupled to pricing logic, making changes expensive and slow.

You’re not managing a pricing model anymore, you’re managing a financial operating system.

This requires:

Clear ownership of pricing operations (who approves exceptions?)

Ruthless standardization (what deviations will you actually support?)

Purpose-built billing infrastructure (Stripe isn’t enough anymore)

Revenue recognition automation (spreadsheets don’t scale)

Could you explain your credit logic to a new CFO in 15 minutes? If not, you’ve overcomplicated it.

Challenge #5: Nobody Owns the Problem End-to-End

The most insidious challenge is organizational. Usage based pricing creates a gap in ownership that most companies ignore:

Product owns usage definitions

Finance owns disputes and reconciliation

Sales owns the initial commit

CS owns expansion

RevOps owns... what exactly?

Who owns the decision when Sales wants a one-off pricing structure? Who says no to a bad deal? Who can explain to the board why committed revenue is declining but consumption is growing?

You need to assign an end-to-end owner of pricing who is accountable for decisions.

This isn’t a committee. It’s a single executive who can:

Make pricing decisions with speed

Arbitrate between Sales and Finance

Approve exceptions (or refuse them)

Own the revenue model strategy

Without this, you end up with drift, exceptions, and a pricing model that nobody understands.

What This Means for RevOps Leaders

If you’re a VP of RevOps or leading GTM operations, usage-based pricing is your problem to solve, whether you asked for it or not.

Finance will bring you the chaos after it happens. Sales will ask for exceptions you can’t support. CS will complain they can’t explain bills. Product will change features that break pricing logic.

You’re the one who has to build the operating model that makes this work.

Here’s where to start:

First, assess whether you’re actually ready. Don’t implement usage based pricing because it’s trendy. Implement it because your value metric genuinely varies with consumption, your customers want flexibility, and you have the operational maturity to support it.

Ask yourself:

Can customers throttle usage without reducing value? (If yes, usage-based won’t work)

Does usage correlate with customer outcomes? (If no, pick a different metric)

Can you measure usage accurately in real-time? (If no, you’ll have disputes)

Will this create more predictable revenue growth? (If no, stick with hybrid)

Second, build the infrastructure before you need it. Don’t bolt consumption onto your existing systems. Purpose-build for it:

Invest in real time usage metering (events, not batch)

Expose usage data to customers before launch

Build scenario modeling for CS and Finance

Create clear pricing documentation (internally and externally)

Third, align the organization first. Usage-based pricing will expose every misalignment in your GTM motion:

Comp plans that incentivize the wrong behavior

CS metrics that don’t reflect their new role

Product roadmaps that ignore revenue impact

Finance processes that can’t handle variability

Fix these before you change pricing. Otherwise, you’re just creating a new way to fail.

Fourth, keep it simple. Every credit pool, rollover rule, and tiering structure adds complexity. The companies winning with usage based pricing are ruthlessly simple:

Snowflake: compute + storage

Twilio: messages sent

Stripe: transactions processed

If your pricing requires a PhD to understand, you’ve lost. Start simple. Add complexity only when the incremental revenue clearly justifies the operational burden.

The Path Forward

Usage based pricing isn’t going away. 78% of companies with consumption models adopted them in the last five years. Another 59% expect usage components to grow as a percentage of revenue this year.

But the winners won’t be determined by who moves to usage based pricing fastest. They’ll be determined by who builds the operational infrastructure to support it.

Because at the end of the day, pricing is a promise. You’re promising customers they’ll only pay for value delivered. But if you can’t measure that value accurately, explain it clearly, and forecast it reliably, you’ve just made a promise you can’t keep.

And broken promises don’t scale.

RevOps Sample Diagnostic template for paid members 👇