The methodology you choose has to match both your selling motion and your operational maturity. An enterprise AE carrying five strategic accounts will forecast differently than an SMB sales team closing fifty deals a month, and a PLG company’s forecast will look different from both. The PLG may have volumes of data for which they could leverage a Machine Learning model to forecast. Below are the core forecasting approaches, their strengths, weaknesses, and how they map to Enterprise, SMB, and PLG motions.

But first a word from our sponsors:

RevOps chaos slowing you down? Juggling disconnected tools, manual reports, and clunky workflows kills productivity and revenue. Zapier automates your processes, seamlessly integrating your sales, marketing, and RevOps stack—so you can focus on growth, not busywork. Start automating today and turn inefficiency into impact. Try Zapier now!

1.1 Top-Down Forecasting

Definition

Top-down forecasting starts with the destination and works backward. The process begins with an overall revenue goal. Often it’s set by executive leadership or the board, which is then cascaded down through geographies, teams, and individual reps.

How It Works

Leadership sets a revenue target based on growth goals, market opportunity, or investor expectations.

That number is divided into quotas for each region and rep.

Pipeline and activity expectations are backfilled to support hitting those quotas.

Pros

Excellent for strategic alignment. Everyone knows the number and the gap.

Works well for long-term planning (annual budgets, headcount models).

Can be done even with limited historical data.

Cons

May be disconnected from reality if the top-line target ignores pipeline reality (i.e. deal velocity)

Can lead to pressure-driven forecasting (“We’ll find a way”) that doesn’t reflect actual deal progress.

Doesn’t adapt quickly to shifts in market conditions.

Best Fit

Early-stage companies without reliable historical close rates.

Annual or multi-year strategic planning sessions.

Enterprise orgs that use this for high-level goal setting, then overlay a bottom-up view for operational accuracy.

1.2 Bottom-Up Forecasting

Definition

Bottom-up forecasting starts with the ground truth. That is every opportunity in the pipeline which is then rolled up to create a forecast. It’s deal level accuracy first, then aggregated up for a forecast.

How It Works

Each rep reviews their open opportunities.

Each deal is assigned a probability or stage weighting based on historical data.

The roll-up across reps and managers becomes the forecast.

Pros

Highly grounded in reality.

Responds quickly to changes (deals added, slipped, or lost).

Encourages reps and managers to own their numbers.

Cons

Bias risk: Reps can be overly optimistic (hope-casting) or conservative (sandbagging).

Quality depends heavily on CRM hygiene (a RevOps biggie!).

Can feel volatile if pipeline is small.

Best Fit

SMB sales motions with high velocity where deal flow is large enough for statistical modeling to be meaningful.

Mature orgs with disciplined CRM use.

PLG sales-assisted motions where expansions and upsells are tracked as opportunities.

1.3 Hybrid Forecasting

Definition

The hybrid approach combines top-down strategic targets with bottom-up operational forecasting. Leadership sets the target, bottom-up analysis tells you whether the pipeline supports it, and the gap between the two becomes the focus for pipeline generation or deal acceleration.

How It Works

Start with the top-down number from strategic planning.

Overlay the bottom-up reality from rep level pipeline data.

Identify and address the gap through enablement, pipeline generation campaigns, or account prioritization.

Pros

Keeps the organization aligned to strategic goals.

Grounded in operational truth, reducing the risk of “happy ears.”

Enables proactive pipeline gap planning.

Cons

Can create tension if the top-down number is significantly higher than the bottom-up reality.

Requires strong cross functional coordination between sales, marketing, and RevOps.

Best Fit

Mid-to-late stage companies that need to balance growth targets with reality.

Enterprise motions where individual deal inspection is critical, but pipeline coverage must also be tracked.

1.4 Method Variations by Selling Motion

Enterprise (Low Volume, High ACV)

Forecasting is deal specific: every major deal is individually inspected.

Heavy use of qualitative intelligence from AEs, managers, and executive sponsors.

Win probabilities may be set manually rather than stage-weighted.

RevOps role: Ensure close plans are documented and validated, run “slip risk” analysis on each deal.

SMB (High Velocity, Lower ACV)

Forecasts rely on historical conversion rates and pipeline coverage ratios (e.g., 3x to 4x coverage for target).

Deals are often stage-weighted automatically using CRM rules.

Less time on individual deal reviews, more focus on trend analysis (win rates, cycle times).

RevOps role: Maintain accurate stage definitions, monitor pipeline health metrics weekly.

PLG (Product-Led Growth)

Forecasts often depend on usage and engagement metrics rather than traditional sales stages.

Key predictive signals:

Active seat growth

Feature adoption

Time-to-value milestones

RevOps role: Partner with product and growth teams to integrate product data into forecasting models.

Overall, this gives us the foundation:

Top-down for strategy

Bottom-up for reality

Hybrid for balance

Tailored execution for Enterprise, SMB, and PLG motions

Now let’s dive into some details to build into your forecasting process.

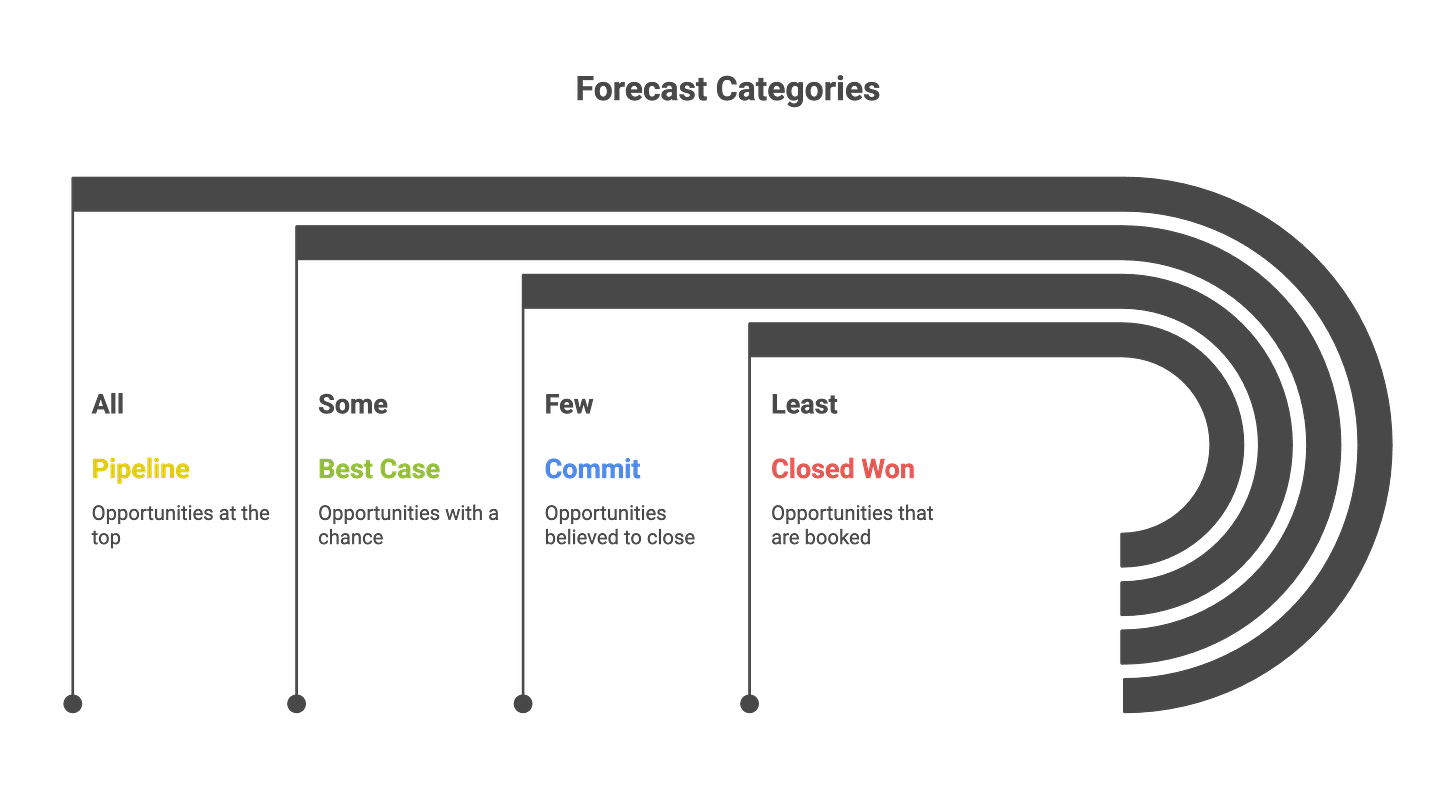

2. Forecast Categories and Definitions

Forecast categories give structure to the conversation about revenue expectations. They provide a common language for sales, RevOps, and leadership to discuss where the number will land. The challenge is that these categories often mean different things to different people, and the reliability of each category can vary based on the selling motion. So how about building a Rosetta Stone of forecasting to remove the ambiguity!

2.1 Common Categories

Pipeline

All open opportunities that could close in the period. This is the largest number you will see in any forecast view. It is useful for understanding potential, but it is not a prediction.

Best Case

Sometimes called Upside. This includes deals that have a chance to close this period but are not fully committed. It is often a mix of opportunities in late stages that have some risk and earlier stage deals that could be accelerated.

Commit

The deals that the rep and their manager believe will close in the period. This is where leadership starts paying close attention. Commit is meant to be a declaration of confidence that the deal will come in. In reality, the reliability of Commit varies widely.

Closed Won

Revenue that has actually been booked. This is the only number you can take to the bank.

2.2 Motion-Specific Definitions

Enterprise

Commit is often tied to specific exit criteria. The deal must have an approved business case, legal redlines in progress, and executive alignment on both sides. Because the deal cycles are long, each Commit is usually scrutinized individually. Accuracy can be relatively high, but a single slip can have a large impact on the number.

SMB

Commit is more statistical. It often includes any deal in certain late stages with a projected close date in the period. The accuracy depends on how well the stage definitions match reality. SMB motions tend to have more volatility because of the sheer volume of deals and shorter cycles.

PLG

Commit can be defined around expansion readiness or renewal likelihood. It may come from a predictive score based on product usage, account health, and historical upgrade patterns. Here, the category may be less about sales judgment and more about data-driven scoring.

2.3 Do Commit Deals Slip?

Yes, often. Industry benchmarks suggest that a meaningful percentage of Commit deals do not close in the expected period. Slippage can happen for reasons outside the seller’s control or because the original forecast call was overly optimistic.

Common customer-driven reasons for slippage

Budget freezes or reprioritization

Delays in legal or procurement processes

Changes in leadership or champion turnover

Common internal-driven reasons for slippage

Weak or single-threaded relationships

Gaps in the business case

Incomplete close plans or missed milestones

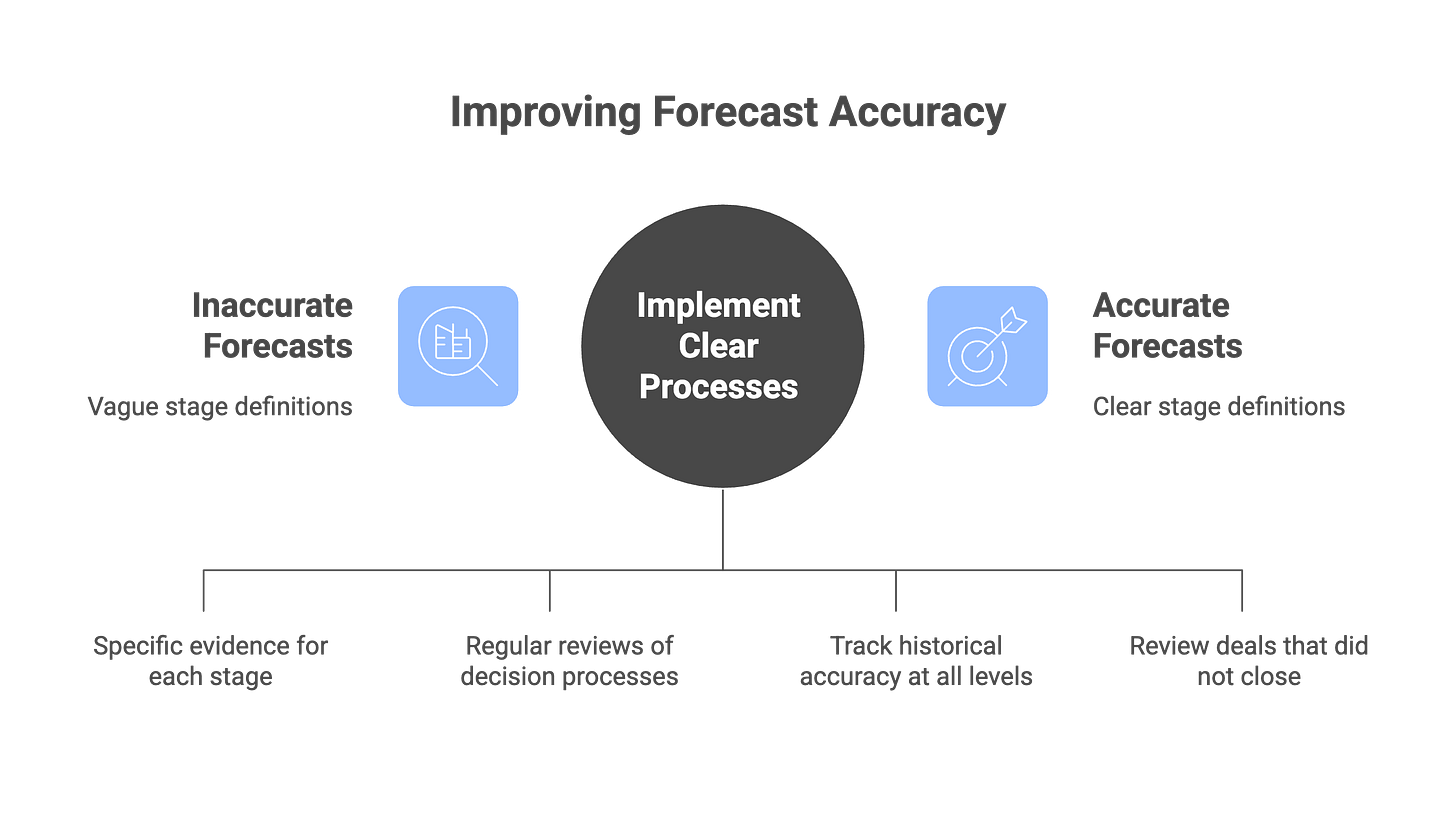

2.4 How RevOps Can Improve Commit Accuracy

Clear exit criteria for each stage

If stage definitions are vague, forecast accuracy will always suffer. Define the specific evidence required for a deal to be called Commit.

Deal inspection cadence

Run regular reviews that go beyond “how is it looking?” and dig into decision processes, stakeholder maps, and key risks.

Manager accountability

Track historical accuracy at the rep and manager level. Managers should be held to improving accuracy over time.

Slippage analysis

At the end of each quarter, review every deal that was in Commit but did not close. Identify the root cause and whether the forecast call was reasonable at the time.

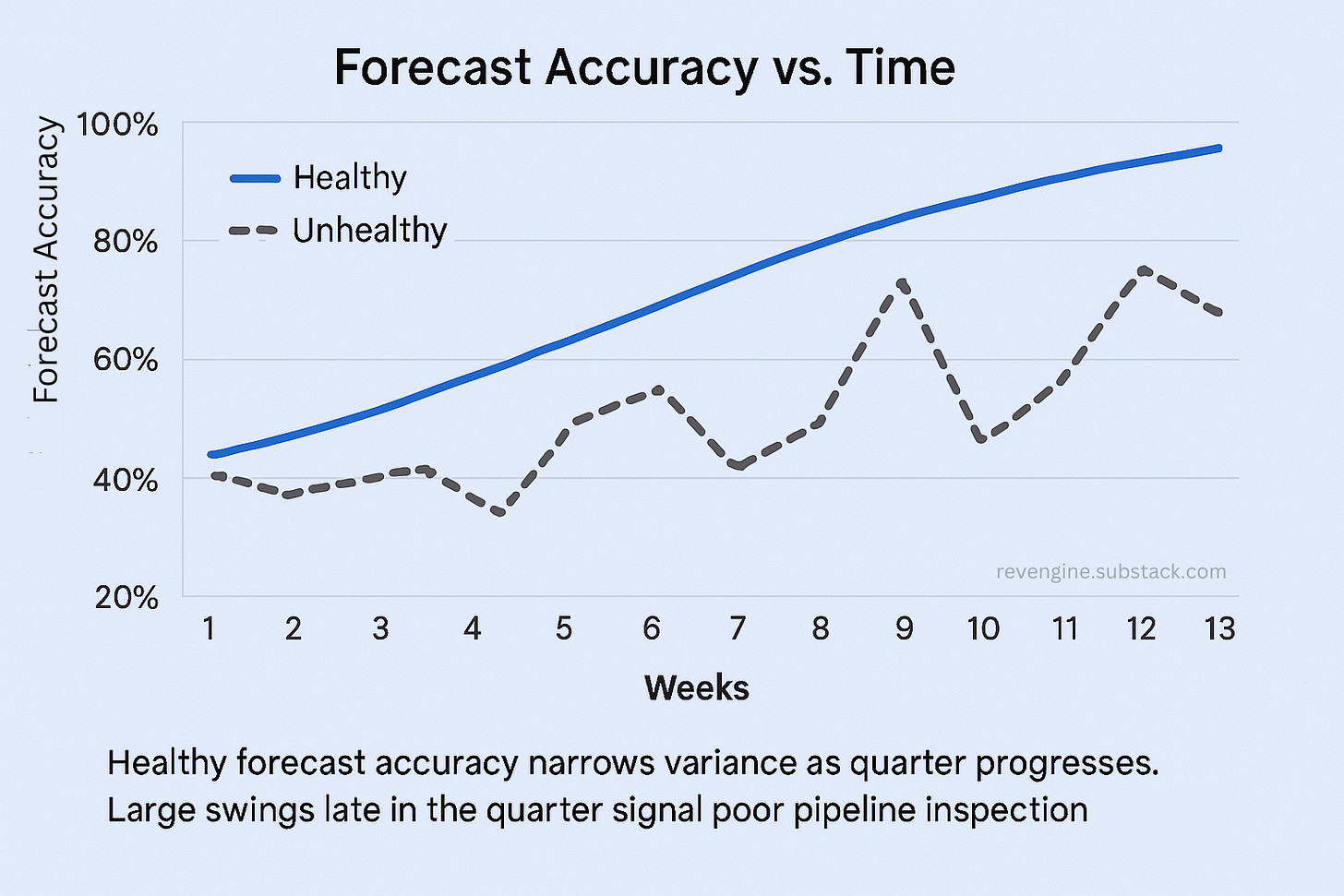

3. Forecast Evolution Over a 13-Week Quarter

A forecast is not a static number. It should evolve as the quarter progresses. Revenue Operations plays a key role in ensuring that the forecast moves from directional to accurate by the time the quarter closes.

Think of the quarter as three phases, each with different RevOps priorities.

Keep reading with a 7-day free trial

Subscribe to RevOps Impact Newsletter to keep reading this post and get 7 days of free access to the full post archives.