As a Revenue Operations leader, I’ve come to believe that much of the go-to-market tech stack, particularly in enterprise sales, hasn’t evolved at the same pace as our buyers have. Our frameworks often assume linearity in decision-making, and our systems still hinge on blunt instruments like MQLs (Marketing Qualified Leads) and MQAs (Marketing Qualified Accounts). These models are increasingly unfit for how large enterprises actually buy.

If your organization sells multiple products or solutions to different personas within the same enterprise, it's time to consider a more nuanced, scalable approach: Buying Groups.

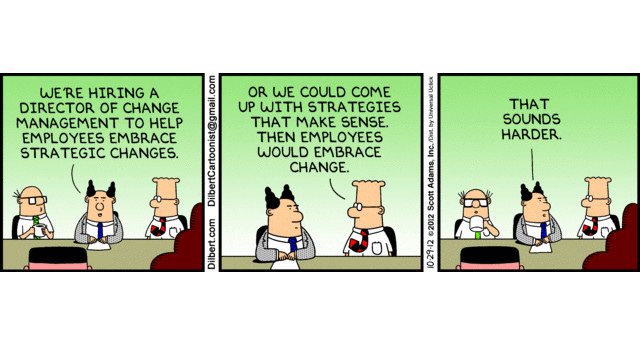

Much like Goldilocks finds three bowls of porridge…

MQLs seem too cold

MQAs seem too hot

But buying committees? Just right.

A word from this week’s sponsor

73% of GTM Leaders find most reports and forecasts useless. As a result, RevOps teams waste 30% of their time drowning in bad data, broken dashboards, and forecasting guesswork. Revlitix replaces data silos, second-hand insights and outdated CRM & GTM analytics with modern reporting and full-funnel forecasting that GTM leaders appreciate. Learn more today. Take a demo and get a $100 gift card for your time.

On 6/3 join me for a conversation with my friends over at Revlitix.

The Problem with MQLs and MQAs

Let’s start with the tools we know.

MQLs, or Marketing Qualified Leads, are contact-level signals. They prioritize engagement, often without context. One highly active individual might trigger follow-up, but in most complex buying environments, that one person is rarely the sole decision-maker.

MQAs, or Marketing Qualified Accounts, attempt to aggregate engagement at the account level. While this is a step forward, MQAs can’t distinguish between different departments or buying centers within the same company. An MQA signal might come from an account’s Finance team, but you’re trying to sell to IT. That creates friction and confusion rather than clarity.

What’s missing is contextual relevance. Specifically, who is buying what and why.

Introducing Buying Groups

A buying group is a defined set of individuals within a single account who collectively participate in a purchase decision for a specific product. Each group is anchored to a particular solution, mapped to roles and personas, and tracked independently, even if they all sit within the same company.

This model mirrors what we see in the field.

Security software may be evaluated by IT, legal, and procurement.

Collaboration tools may be purchased by operations, with input from HR and finance.

A multi-product company may sell into both of these groups within the same enterprise at the same time.

Instead of triggering engagement based on isolated leads or undifferentiated accounts, a buying group model identifies and tracks the specific set of stakeholders who matter for each solution.

What You Need in Place First

Adopting a buying group model is more than a systems change. It is a strategic shift. It requires a structured and disciplined go-to-market framework that is built by product, not just by company.

Here’s what needs to be in place:

1. ICP by Product

Move beyond a one-size-fits-all ICP. Define who your ideal customers are for each product or solution line. This includes firmographics, pain points, budget authority, and relevant buying cycle stages.

2. Persona Mapping

Identify key personas per product. These include the economic buyer, the champion, the influencer, and the blocker. Understand each persona's goals, objections, and buying triggers.

3. Customer Journey by Persona

Map out how each persona enters and moves through the funnel. Document the influence each has on others in the buying group. Determine who drives consensus and who holds decision-making authority.

Use Data to Build with Confidence

If you’re going to reorient your strategy around buying groups, your data must guide the way. Here are several practical and high-leverage ways to do that:

Win/Loss Analysis

Look at past deals. Identify which personas and roles were involved in closed-won opportunities by product. Use this to predict future buying group behavior. If you do not have the contacts associated to the opportunity it might be a good idea to start.

Engagement Scoring Across the Group

Develop aggregate scoring models that look at the engagement of the entire group, rather than a single lead.

Intent and Enrichment Data

Platforms like Cognism, 6sense, Bombora, Clay, Clearbit, and ZoomInfo can enrich contacts and accounts while also identifying in-market behavior.

Content Analytics by Persona

Track which assets resonate with specific personas. Use those insights to tailor your nurture streams and outbound messaging.

The most advanced go-to-market teams use this data not just for insight, but to power scalable execution. This is especially true in ABM or ABX models, where personalization and timing are critical.

What System Changes You’ll Need to Make

Shifting to a buying group approach means your underlying systems need to reflect the complexity of real-world decision-making.

CRM Architecture

You’ll need to support multiple opportunities per account, each with its own set of linked contacts. Contacts should be tagged by role and by product relevance.

Marketing Automation

Segmentation logic must account for persona and product combinations. Dynamic content should reflect the unique goals of each buyer within the group.

Lead Routing and Scoring

Move away from individual scoring. Instead, score based on group engagement readiness. This includes the number of contacts engaged, depth of engagement, and diversity of roles represented.

Attribution and Reporting

Shift attribution from the lead or account level to the buying group. Track conversion rates, velocity, and pipeline progression by group type.

My two cents

This is not a light lift. But it reflects the complexity of modern buying behavior. According to Gartner, the average B2B buying group includes between 6 and 10 stakeholders. Each person does their own research and often holds different opinions (Gartner, B2B Buying Journey, 2022). Treating them as a monolith simply doesn’t work.

Rallying the organization

Shifting from MQLs and MQAs to buying groups requires more than just reconfiguring tools. You need alignment across departments and a plan for adoption.

Start Small

Choose a single product line, vertical, or region. Pilot the model with a controlled group and measure the results.

Let the Data Speak

Track metrics like group engagement, opportunity conversion, and sales cycle duration. Show clear comparisons to legacy MQL or MQA models.

Educate and Enable

Align sales, marketing, and product marketing teams. Provide training and updated playbooks. Ensure that everyone understands who the buying group is and how to engage them effectively.

Secure Executive Support

Tie this initiative to top-line goals. This could include increased ACV, faster deal velocity, or deeper product penetration. When leadership understands the strategic value, prioritization becomes easier.

So if you have multiple products selling to different personas

The way enterprise buyers make decisions has changed. We can no longer rely on frameworks that assume one lead or one account equals one opportunity. The world is more complex than that.

Buying groups give us a smarter, more targeted way to engage with customers. They reflect how buying actually happens in enterprise organizations. And they give Revenue Operations teams the clarity needed to drive higher-quality pipeline and better customer experiences.

If your systems and processes are still anchored in MQLs and MQAs, it’s worth asking whether they are built for today’s buyer—or for yesterday’s funnel.

For paid members below is an internal workshop guide

Before you go… RevOp Impact Offerings

There are 4 ways I can help you:

1/ RevOps Course: Unleashing ROI (RevOps Impact). A ten-week RevOps course. Lessons from my career scaling from $10M to $100M+. Join 150+ alumni.

2/ Sales Ops Masterclass. A six-week virtual, live instruction SalesOps course designed to take your sales operations skills to the next level.

3/ You’re a GTM Startup. Sponsor this newsletter and reach 4,600+ tenacious revenue leaders. Reply to this email if you’re interested in receiving a media kit.

4/ 1-on-1 RevOps Coaching with me. Let me help you push through the ceiling

Keep reading with a 7-day free trial

Subscribe to RevOps Impact Newsletter to keep reading this post and get 7 days of free access to the full post archives.