Build a Predictive Deal Score

Forecast accuracy is one of the most important challenges for commercial teams. Sales leaders want to know which deals are progressing with true buyer interest and which are at risk of slipping. Traditional activity tracking and legacy black-box scores often fail to deliver clarity. Revenue Operations has the opportunity to build a deal score that is transparent, data-driven, and predictive of current-quarter revenue.

But first, a word from our sponsors

RevOps chaos slowing you down? Juggling disconnected tools, manual reports, and clunky workflows kills productivity and revenue. Zapier automates your processes, seamlessly integrating your sales, marketing, and RevOps stack—so you can focus on growth, not busywork. Start automating today and turn inefficiency into impact. Try Zapier now!

What Makes a Good Deal Score

A strong deal score should:

Predict which opportunities are likely to close in the current quarter.

Reflect buyer actions instead of focusing only on seller activity.

Provide transparency so that all stakeholders can understand what drives the score.

Be tunable and adaptable to each company’s historical data.

Align the organization around a single definition of deal health.

Core Deal Factors to Include

I break down a few key areas to include into your deal score, namely:

Engagement tracking

Multi-thread tracking with Contact Roles

Intent signals during the opportunity

MEDDICC field data

1️⃣ Engagement Tracking

Engagement is a clear signal of intent. Metrics to capture include meeting frequency, demo attendance, replay activity, collateral engagement, and email responsiveness. One interesting thought brought to me by Shaun Guidolin on LinkedIn was to track response rate throughout the life of a deal. For example:

First 30 days:

Emails sent: 8

Emails responded: 6

Response rate: 75%

Second 30 days:

Emails sent: 14

Emails responded: 4

Response rate: 42%

Third 30 days:

Emails sent: 8

Emails responded: 1

Response rate: 13%

Opportunity sales cycle: 112 days

Final stage: Closed Lost

One thing I like about that is that you clearly see a drop in responsiveness. Something went wrong with the deal and it resulted in a loss for the sales team.

RevOps Setup:

Custom fields: Last Engagement Date, Number of Meetings in Last 30 Days, Collateral Views, Email Response Rate.

Common tools: Outreach, Salesloft, Gong, Highspot, HubSpot, Salesforce Inbox.

Here are some gotchas when setting this up:

Tricky Parts of Tracking Engagement

Marketing vs. Sales Engagement

Challenge: Marketing touches (webinars, nurtures) inflate deal scores if not separated.

Solution: Track marketing and sales activity in separate fields. Weight marketing higher early stage, lower later. Use source tagging to keep clean.

Prospect Replies vs. Outbound

Challenge: Systems often count rep emails the same as buyer replies.

Solution: Create fields for Prospect Replies and Average Reply Time. Weight buyer-initiated activity more heavily.

Multi-Channel Attribution

Challenge: Engagement comes from multiple sources (email, deal room, product usage) and can be double-counted.

Solution: Centralize activity into one object. Prioritize buyer-initiated actions. Deduplicate overlapping events.

Noise from Automation

Challenge: Automated nurtures, out-of-office replies, and bot activity inflate engagement.

Solution: Filter low-value events. Set minimum thresholds (e.g., content view >30 seconds, meeting attended).

Linking to the Right Opportunity

Challenge: Engagement often attaches at account level, not opportunity level.

Solution: Enforce opportunity-contact linkage. Use tools like People.ai or Clari to auto-match interactions.

2️⃣ Multi-Thread Tracking with Contact Roles

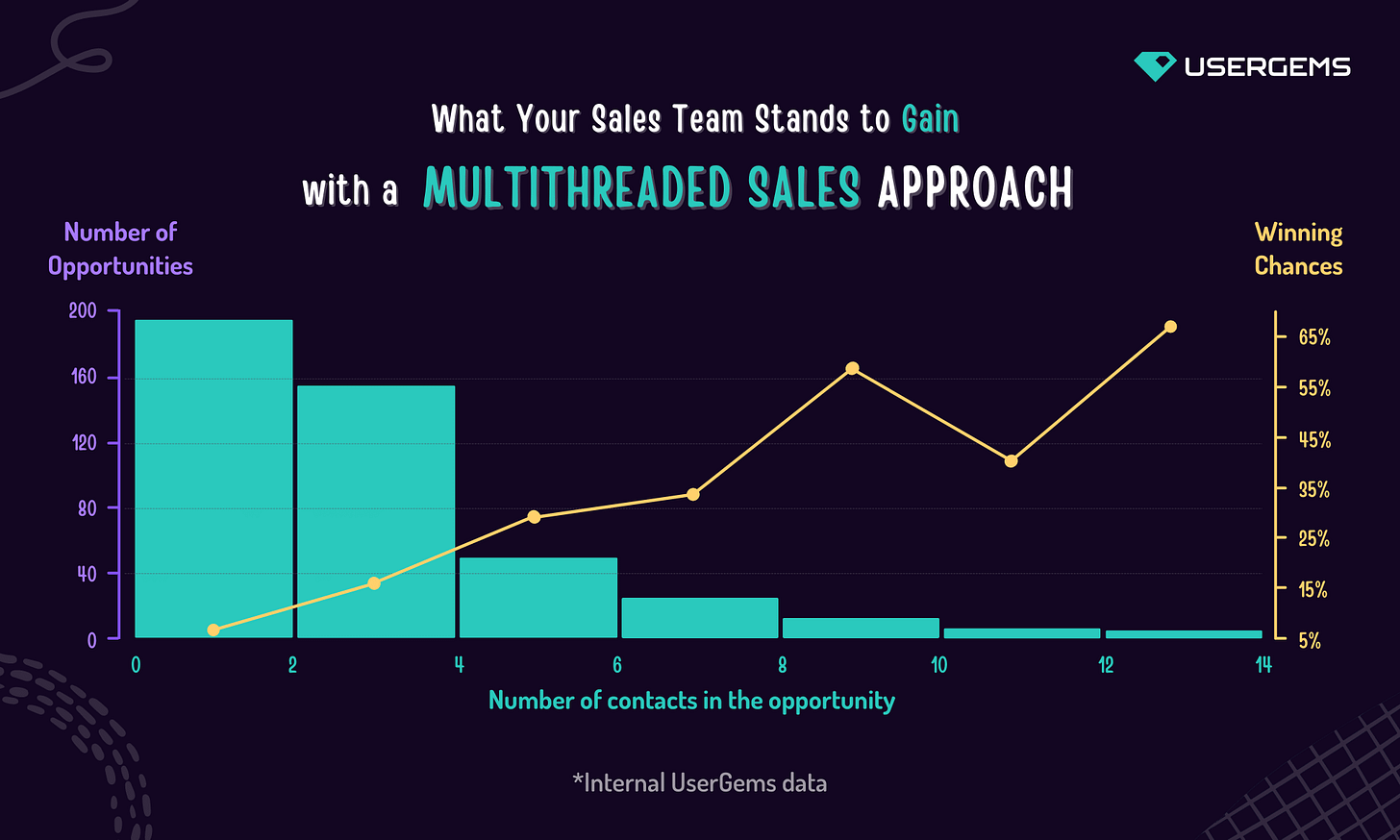

Opportunities that include multiple stakeholders have a higher likelihood of closing. Tracking contact roles ensures opportunities are not left in a single-threaded state. If you’re selling mid market sized deals ($50K+) and enterprise sized deals ($100K+) then multithreading is going to be critical to track.

RevOps Setup:

Custom fields: Number of Contact Roles, Economic Buyer Identified, Champion Identified, Technical Evaluator Identified.

Add stage requirements that enforce contact role mapping.

Common tools: Salesforce Contact Roles, People.ai, Clari.

The set of contact roles should match both your selling methodology and the way decisions actually get made in your customer base. Too many roles creates noise, too few limits visibility. Here’s a structured way to approach it:

Core Contact Roles (common across most methodologies)

Economic Buyer: Has budget authority and makes the final financial decision.

Champion: Advocates internally for your solution and helps guide the deal.

Technical Evaluator: Validates technical fit, integrations, and security.

Decision Maker: May overlap with Economic Buyer, but in complex orgs, it can be distinct.

End User / Practitioner: Uses the product daily, provides input on usability.

Procurement / Legal: Handles contracts, vendor onboarding, and negotiations.

MEDDICC Alignment

If you are using MEDDICC, align roles directly to the framework:

Economic Buyer (E in MEDDICC)

Champion (C in MEDDICC)

Technical Evaluator / Influencer (Decision Criteria and Decision Process inputs)

Challenger / Solution Selling Alignment

For methodologies focused on consensus-building:

Coach (similar to Champion but less formal power)

Executive Sponsor (C-level alignment, especially for enterprise deals)

Blocker / Detractor (optional role to document those who may resist)

Practical Salesforce Setup

Create a Contact Role picklist tailored to your methodology.

Recommended base list: Economic Buyer, Decision Maker, Champion, Technical Evaluator, End User, Procurement, Legal, Influencer, Detractor.

Use required role mapping at key stages (e.g., must have Economic Buyer and Champion identified before stage 3).

Track Number of Roles Attached and Coverage of Key Roles as scoring inputs.

3️⃣ Intent Signals Outside the Opportunity

Buyer intent often shows up outside the opportunity itself. Most companies will use signals to detect “warmbounding”. Meaning it’s a company the sales team should outbound to because they’ve detected a signal. But signals such as new job openings, funding announcements, or technology changes can indicate urgency and investment priorities during the opportunity. I would encourage RevOps teams to continue scanning for signals while an opportunity is being qualified or in mid sales cycle.

RevOps Setup:

Custom fields: Hiring Signals Active, Funding Event Detected, Technology Changes Observed.

Use reverse ETL to bring external signals into the CRM.

Common tools: ZoomInfo, LinkedIn Talent Insights, Crunchbase, Bombora, 6sense.

Here’s a few examples of how this could be viewed in practice:

Job openings: A prospect posts multiple roles in data engineering during an active evaluation, suggesting upcoming investment in infrastructure.

Funding announcements: A Series B raise while the deal is open may accelerate urgency for new tools to support growth.

Technology changes: A competitor’s software is removed from their tech stack, signaling openness to switching vendors.

Executive hires: A new CRO or CIO is appointed, often triggering budget reallocation and priority shifts.

Regulatory events: A new compliance requirement surfaces mid-cycle, creating urgency for solutions that address the change.

4️⃣ MEDDICC Field Data

Full article access available for paid subscribers. For those who still have their education budget for the year. 👇

Keep reading with a 7-day free trial

Subscribe to RevOps Impact Newsletter to keep reading this post and get 7 days of free access to the full post archives.